Our fiat money is, just like the systems we are part of (countries, governments, companies etc.) a collectively agreed upon imagination. Conversely to what we are told, since the $ has been decoupled from gold in 1971, fiat money is no longer backed by anything but our joint belief.

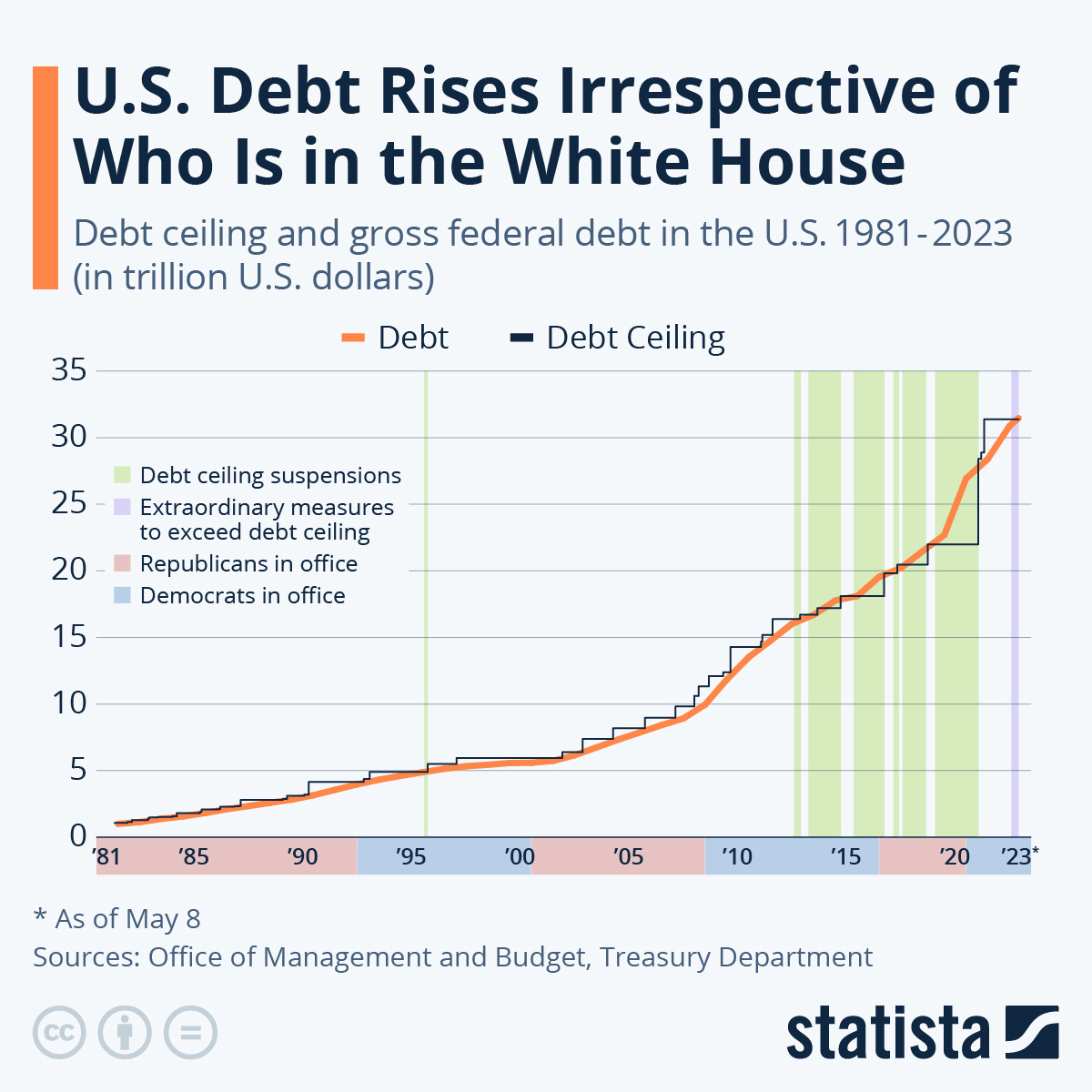

With the incessant money printing going on and the ever increasing government debt ($34,000,000,000,000 for the US alone, i.e. $100,000 for every US citizen), more and more people are questioning how much longer this house of cards can stand.

"I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop." — Friedrich August von Hayek (1984)

Welcome to Bitcoin

The abuse of our money has been the very reason for the creation of Bitcoin. It was launched at the end of the financial crises with the following headline written into its genesis block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Bitcoin is this “sly roundabout way that they can’t stop.”

Why has Bitcoin gone from being worth cents to $60,000 and a market cap of $1.2 trillion in less than 15 years?

More and more people understand the value of Bitcoin in a world where central banks and governments are out of control.

What is money?

Money serves three purposes: 1) store of value, 2) medium of exchange and 3) unit of account.

A critical aspect of the quality of money is that it preserves its value. The issue with all fiat currencies is that central banks can create more of it at will. And especially in recent years they have done so increasingly and recklessly. Plainly spoken it’s legalised theft and an example that legal and ethical are two very different things.

Inflation in consumption items and asset values like stocks and real estate is a direct function of the creation of money. Yes, there are other factors but this is the main factor few economists and central bankers talk about because if they were we would realise that the rigged game they are playing with us.

Central banking is legal theft

Whenever a central bank creates more money it directly devalues all the existing money. Your $/€/£ are immediately worth less. And they call it inflation.

Imagine there were only $1 million in the world. Suddenly the central bank decides that its government needs more money and they create - with the push of a button - another $1 million. The amount of monetary units has doubled but nothing else has changed. Everything will increase in price because double the amount of units are now chasing the same amount of assets and goods.

This is how the system has been stealing from all of us since the money has been delinked from gold - a scarce asset. Why scarce? Because it costs a lot of energy to mine gold and the new supply is therefore limited.

Bitcoin — the best money

Bitcoin is the new, much improved gold because not only is it scarce and hard to create but it has absolute scarcity.

No government nor anyone else can ever create more Bitcoin. There will only ever be 21 million. It’s therefore the hardest/best money there is.

As more and more people understand this very core principle about the quality of money they buy Bitcoin and this pushes up the price - because of its limited supply.

This process has been accelerated with the recent launch of Bitcoin spot ETFs (exchange-traded funds) that make buying Bitcoin much easier for the traditional financial rails and institutions and everyone else. It has been the most successful ETF launch ever.

Bitcoin is not a Ponzi scheme

Bitcoin is not a ponzi scheme because existing investors are not paid by new investors. The price keeps going up because of its limited supply and the fact that the majority of Bitcoins are not available for sale.

70% of Bitcoins have not moved/been sold in the last year and 80% not in the last six months because holders increasingly understand Bitcoin continuously increasing in value. It’s the perfect store of money so why would you sell it if you don’t have to.

Bitcoin has been the best performing asset

What scares many people is the extreme volatility. The reason is that even today it is still very early days and most people don’t own any Bitcoin. Its total market cap is still less than 10% of that of gold. The market is still in its learning phase and therefore speculation is ripe which is reflected in the price. Don’t confuse price with its underlying value.

Despite its volatility, Bitcoin has demonstrated to be the best performing asset over the past decade even and especially when adjusted for its volatility/risk. While it goes down a lot, it goes up a lot more and will continue to do so. As Bitcoiners say: It’s just math.

With governments and central banks getting ever more out of control, there is no better time to hedge yourself and own some Bitcoin. There will ever be only 21 million so not even every current millionaire (56 million) nor every US millionaire (22 million) will ever be able to own a full Bitcoin. Far from it because the majority of Bitcoins are not for sale which creates even more upside pressure on the price.

And if you think Bitcoin is expensive at $60,000 wait until it’s $100,000 then 200,000. The question is not if but when.

Owning Bitcoin is owning a piece of the future financial system free from governments manipulation, control and especially devaluation.

Bitcoin is peace

By holding Bitcoin you are voting with your money. Governments would not be able to go to wars if they could not print money at will as they would need to raise taxes to pay for the wars - a very unpopular decision. It means we would enter wars only for defence or where the majority explicitly wants it and is willing to pay for it.

Just like the state and church are meant to be separated, so is money meant to be independent of governments’ control. And with Bitcoin we now have to technology to complete this separation. The world will be much better off for it.

Disclaimer: This is not financial advice but merely reflects my opinion. Bitcoin is highly volatile. Invest only what you are willing to loose.

And this is how welcoming the Bitcoin ecosystem is: Here’s nobody me discussing Bitcoin with Michael Saylor, CEO of MicroStrategy, a public company that owns $12 billion worth of Bitcoin. We talked for 12 mins. I don't know of any other industry where that happens.